nebraska auto sales tax

Sales and Use Tax Regulation 1-02202 through 1-02204. Department of Motor Vehicles.

Nebraska Car Sales Tax Reviews And Estimates Getjerry Com

Nebraska Sales Tax on Cars.

. How Does Sales Tax Apply to Vehicle. In addition to our brief summary you should study Vehicle Importation Regulations and then contact an. Ad Get Nebraska Tax Rate By Zip.

Free Unlimited Searches Try Now. Here are five additional taxes and fees that go along with a vehicle purchase. This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new.

This is less than 1 of the value of the motor vehicle. Vehicle Title Registration. The state of NE like most other states has a sales tax on car purchases.

Nebraska car sales tax is 55 for any new or used car purchases. Average Local State Sales Tax. A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6.

The minimum combined 2022 sales tax rate for Lancaster County Nebraska is. Nebraska only charges the. Is subject to sales and use tax.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Subsequent brackets increase the tax 10 to. Deliveries into a Nebraska city that imposes a local sales tax are.

The sales tax rate is calculated at the rate in effect at that location. Qualified businessprofessional use to view vehicle. The point of delivery determines the location of the sale.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. 49 rows Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards. Maximum Possible Sales Tax.

50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human. With local taxes the total sales tax rate is between 5500 and 8000. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825.

Nebraska vehicle title and registration resources. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car. Sales and Use Tax Regulation 1.

The Nebraska state sales and use tax rate is 55 055. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated. Nebraska has recent rate changes Thu Jul 01 2021.

Nebraska has a state sales tax of 55 percent for retail sales. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. When state and county rates.

Ad New State Sales Tax Registration. Bringing a car into America from another country can be a tricky process. 301 Centennial Mall South PO Box 94789 Lincoln NE 68509- 4789 402 471-3918 State of Nebraska.

Free Unlimited Searches Try Now. Auto Sales Tax information registration support. What is the sales tax rate in Lancaster County.

Additionally city and county governments can impose local sales and use tax rates of up to 2. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. This is the total of state and county sales tax rates.

Ad Get Nebraska Tax Rate By Zip. Additional fees collected and their distribution for every motor vehicle registration issued are. A transfer of an ATV or UTV pursuant to an occasional sale as set out in.

The state sales tax rate in Nebraska is 5500. Purchase of a 30-day plate by a.

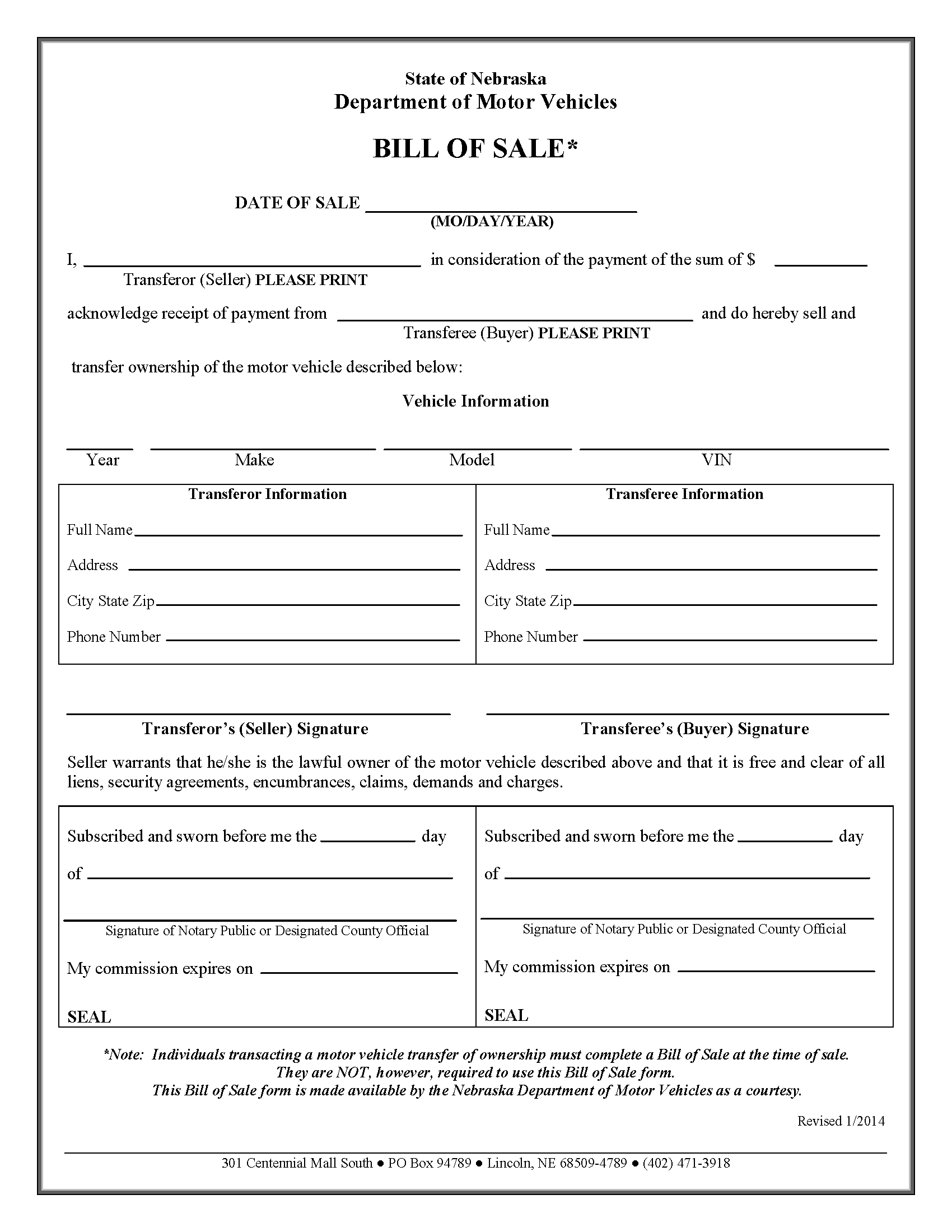

All About Bills Of Sale In Nebraska The Forms And Facts You Need

The Official Kansas State License Plate The Us50 State License Plate License Plate Kansas

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Free Nebraska Motor Vehicle Dmv Bill Of Sale Form Pdf

2008 Jeep Wrangler Big Upgrades Unlimited Sahara Mods Jeep Wrangler 2008 Jeep Wrangler Jeep Wrangler For Sale

Nebraska Vehicle Sales Tax Fees Find The Best Car Price

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

How To Become A Trucker A Trucking Infographic Truck Driver Trucker Quotes Truck Driving Jobs

Used Electric Cars Electric Cars Electricity

Nebraska Vehicle Sales Tax Fees Find The Best Car Price

Pacific Life Life Logo Life Annuity

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Tampa Bmw Suspension Repair At A J German Motorenwerke When Your Car Makes Noise When Turning Call The Experts In German Auto Re Tampa Bmw Repair

Old Illinois License Plate Tag White Blue Mk3845 Auto Garage Etsy License Plate Vintage License Plates Illinois

Sales Tax On Cars And Vehicles In Nebraska

Nebraska Vehicle Sales Tax Fees Find The Best Car Price

Cheap Lexus Es 300 94 For Sale In Nebraska 1999 Cheap Cars For Sale Lexus Es Lexus